Reminder: HMRC requirement to register your Trust by 1st September 2022

It is now a legal requirement for all Trusts to be registered with HMRC. This is called the Trust Registration Service (TRS). Register by 1st September 2022.

Three crucial lessons for weathering the stock market’s storm

Investors can always expect uncertainty, but reacting to markets is a sure fire way of derailing progress towards your financial goals. Justin shares three crucial lessons for weathering the stock market’s storm

What happens when you fail to time the market?

Despite what some investment managers may tell you, there is no way to time buying and selling in the stock market. This hypothetical example illustrates what happens to your investment if you miss a handful of the best days or weeks over a 25-year investment period.

Justin speaks at the FT Investor Chronicle’s ‘Future of Private Investing’ conference

Justin was a panel member at FT Investor Chronicle's 'Future of Private Investing 2022' conference. He discussed the role of investing at every stage of the retirement journey.

NS&I Premium Bond prize fund explained – what does the rate rise mean?

Premium bonds from NS&I are the UK's biggest savings product and their prize fund rate is rising from 1% to 1.4% in June 2022. My latest video explains how the prize fund differs from interest, what your chances are of winning the £1m premium bonds jackpot, and when you should consider them.

Two steps forward, one step back: Is a bear market on the cards?

This year’s market decline of 17% has now passed the annual average of about 14%, with fears that it will extend to 20% - the technical definition of a “bear market”. Discipline & patience are needed for a successful investing experience.

Do downturns lead to down years when investing?

Volatility is a normal part of investing. Stock market declines over a few days or months may lead investors to anticipate a down year. But the US stock market had positive returns in 17 of the past 20 years, despite some notable dips in many of those years.

The case for staying invested (always)

Diversification, time in the market and a steady head can help investors achieve their long-term financial goals by avoiding the pitfalls of emotionally driven, badly timed mistakes. The reasons to stay invested (always).

Bank of England raises base rate to 1 per cent to tackle soaring inflation

The Bank of England has raised interest rates by 0.25% to 1 per cent, in a bid to curb soaring inflation. The monetary policy committee voted on 5th May 2022 to raise the Base Rate to tame inflation, which hit 7% in March 2022.

The real enemy - Inflation

The number one enemy of the long-term investor is the financial dragon called inflation (the silent but steady increase of prices over time).

Meme investing? Try human ingenuity instead

When Wall Street or meme investors think they can capitalise on “mispricing,” they’re not betting against Wall Street so much as they are betting against human ingenuity.

Even geniuses cannot prevail against the machinations of the markets: Sir Isaac Newton’s story

Justin explores Sir Isaac Newton’s financially disastrous moves during the South Sea Bubble of 1720. Swept up by the enthusiasm of the stock market, he lost a fortune buying and selling shares, by speculating instead of investing prudently.

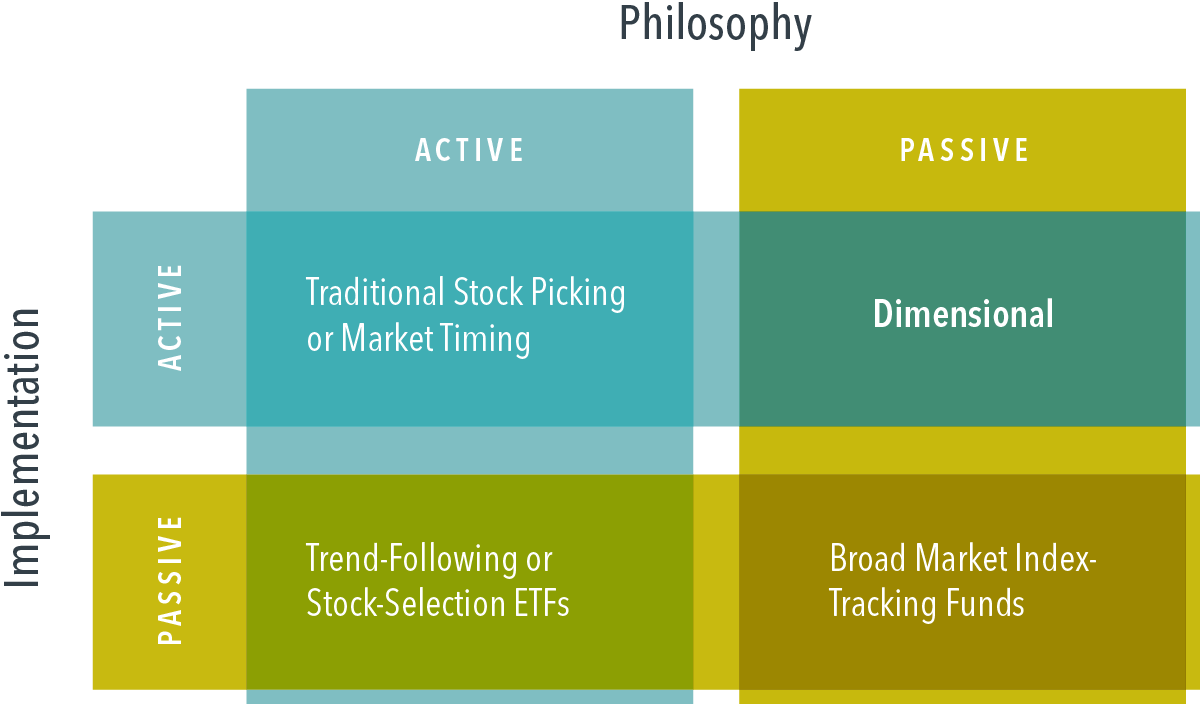

What’s in a name? Active vs passive investing in practice

Active vs passive investing is a phrase we hear regularly, but the binary labels have become outdated. In this article Justin explains a more nuanced framework for assessing the active / passive distinction separately for an investment approach’s philosophy and its implementation. With information from Dimensional Fund Advisors.

Will inflation hurt stock market returns?

Will inflation hurt stock market returns? History shows that stocks and shares tend to outpace inflation over time - a valuable reminder for investors concerned that today’s rising prices will make it harder to reach your long-term financial goals.

Justin on the panel of Boring Money webinar for the Over 40s Club: Investing

Justin was the retirement planning specialist on the panel of Boring Money’s Investing webinar for their Over 40s Club, hosted by Holly Mackay.

The perilous decline of long-term investing - From Visual Capialist

I endorse a buy and hold investment strategy, like Warren Buffet. But as of June 2020, we’ve seen a decline in long term investing with the average holding period down to just 5.5 months, as Visual Capitalist explains.

Snow shaker predictions for the markets (and the investor) in 2022

2022 follows the most shocking and terrifying couple of years for investors since the Global Financial Crisis of 2008-09. In this article I explore market predictions for the New Year and why what matters most is investor behaviour.

A Teachable Moment: Let the compounding proceed, uninterrupted

Reflecting on Alan Greenspan’s ‘irrational exuberance’ speech in 1996, Justin looks at how not even a central banker can predict the stock market. Get invested, stay invested and ignore the market noise.

How seriously should investors take inflation?

Inflation has been on the rise recently in the UK and around the world. Is this rise transitory, as central bankers are saying it is, or persistent and therefore cause for concern?

Investing for children or grandchildren – the Child SIPP and JISA

47% of grandparents increased their investing contributions for their grandchildren over the past year. They are big fans of investing accounts like Child SIPPs and the Junior Stocks and Shares ISA.