NS&I Increases Rates – A Safe Option if You’re Holding Significant Cash in Retirement

Discover how NS&I’s newly increased 1-Year British Savings Bond rates (up to 4.18% AER) offer a secure, government-backed savings option for individuals approaching or in retirement.

How Much Impact Does the UK Prime Minister Have on Your Investments?

As an investor, you might wonder how the occupant of 10 Downing Street influences the direction of your investment portfolio. It's a common question: does the UK Prime Minister's identity matter to market performance? Let’s explore.

A Constant Chain of Surprises

Experienced investors know that uncertainty is a constant companion. Uncertainty takes various forms. As former US Secretary of Defense Donald Rumsfeld once said, there are known unknowns (the things we know we do not know) and unknown unknowns (the things we don't know we don't know).

The Value of Having a Financial Coach in your Corner

Sometimes, it’s difficult to explain in words the value we aim to deliver. Dimensional Fund Advisors sum it up nicely. Helping you manage the emotions of fear and greed to stay invested and remain disciplined.

Dimensional Fund Advisors: You Can Do Better Than Indexing

How would you say Dimensional Fund Advisors differs from a pure index fund company? Watch this video to understand the important difference.

The Folly of Forecasting

Each New Year, market analysts make bold predictions about stocks, shares and bond performances. But here’s why forecasting is a folly

Retiring Successfully with Justin King on The Rational Reminder Podcast

Justin is a guest on the popular Rational Reminder Podcast with hosts Cameron Passmore and Benjamin Felix discussing his book, The Retirement Café Handbook. They chat about why being a rational investor is key to a successful retirement.

The Stock Market is all Around You

The stock market might be one of the most misunderstood concepts in the world. Given its central role in helping investors become financially independent, it’s crucial to understand what it is, what it isn’t, and how it functions.

The randomness of global stock market returns

It is difficult to predict future returns by looking at the past, as shown by the performance of global stock markets since 2003. A diverse global portfolio can help capture a broader range of returns and deliver more reliable outcomes over time.

How Cycles of Hype Distract Investors

There are a few ways in which investors distract themselves from their long-term plans. One is by buying into the cycles of hype that appear when specific trends, sectors, or technologies become popular. Here I discuss recent and the latest cycles of hype including Artificial Intelligence (AI) and how to avoid becoming distracted.

When headlines worry you, turn to your investment plan

In March 2023, US regulators took control of Silicon Valley Bank, shortly followed by Signature Bank. That move will do little to quell increasing anxiety amongst investors, many of whom are eyeing their portfolios for exposure to these and other regional banks. Rather than rummaging through your portfolio looking for trouble when headlines make you anxious, turn instead to your investment plan. Here’s how.

Why Invest if Cash is Giving a Return?

Following the recent increase in the Bank of England base rate to 4%, you might legitimately ask why you should invest in volatile or “risky” assets when your cash is providing a return of 4%. Justin explains why the need for investing, using a diversified portfolio of global equities as a way to explain his rationale.

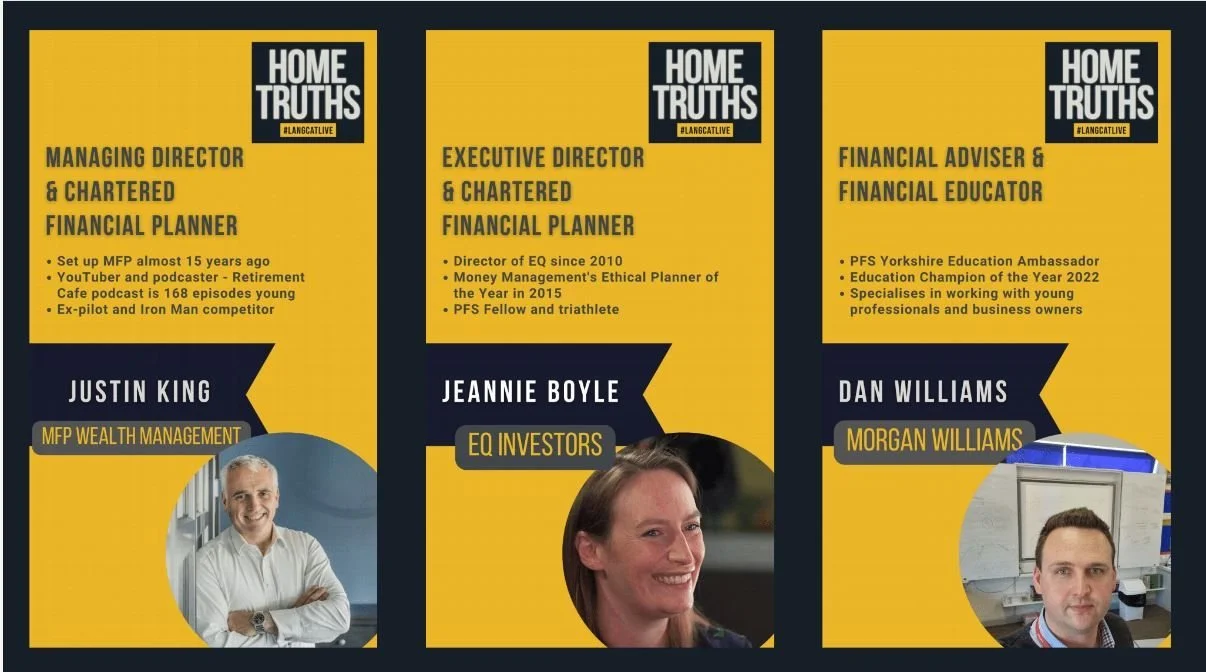

Speaking up for investors at The Lang Cat’s ‘Home Truths’ Conference

Justin was asked to represent a growing tribe of financial planners cheering for the consumer as last week’s ‘Home Truths’ event held by financial research company, The LangCat in London.

Eight Billion Consumers

The world’s population is believed to have crossed the eight billion number for the first time in late 2022. The concern shared by many people is that unchecked population growth will lead to increased competition for resources, causing environmental degradation and economic instability. I share a different view in this article.

The Magic Ingredients of Compounding

Compound interest is nothing more than earning interest on interest. In year two, it may seem insignificant, but given enough time, the numbers become substantial. Think of it as a snowball that slowly grows into an avalanche. But do you have the two secret ingredients for success?

This has been a test: Developing a Financial Plan You Can Stick With

Think back to December 2019. The economy was humming. Unemployment, interest rates, and inflation were at historically low levels. Could anyone have predicted what happened next? If so, how would you have reacted with your investment portfolio?

People have memories. Markets don’t.

People have memories. Markets don’t. And that’s a good thing. So, as you start 2023, take a lesson from the market. Don’t begin this new year bogged down by what happened last year. Give yourself the opportunity to start fresh.

Dimensional’s Takes on the 5 Biggest Financial Topics of 2022

Every year, Dimensional produces a range of resources and analysis to help financial professionals like me and investors like you make smart, informed decisions. Here is a look at some of the industry’s hottest topics this year and what Dimensional had to say.

Trust the financial adviser who trusts the market

With around 43,000 qualified financial advisors in the UK, how can you feel confident you’ve picked the right one? Trust a financial adviser who trusts the markets. Eliminate stock pickers and market timers, and go with the evidence.

How research into failing stock-pickers inspired the Index Fund (and the latest development)

Investors actively trading are not just potentially missing out on the expected return of the market, they’re stressed out. The creation of the Index Fund has done wonders to educate investors on the most likely strategy for success, but financial professionals like me need to do more.