Justin shares retirement expertise with financial advisers as FTAdviser panelist

On 19th May 2022, I sat on the panel of the FTAdviser’s Later Life Planning Summit to debate the role of the later life adviser.

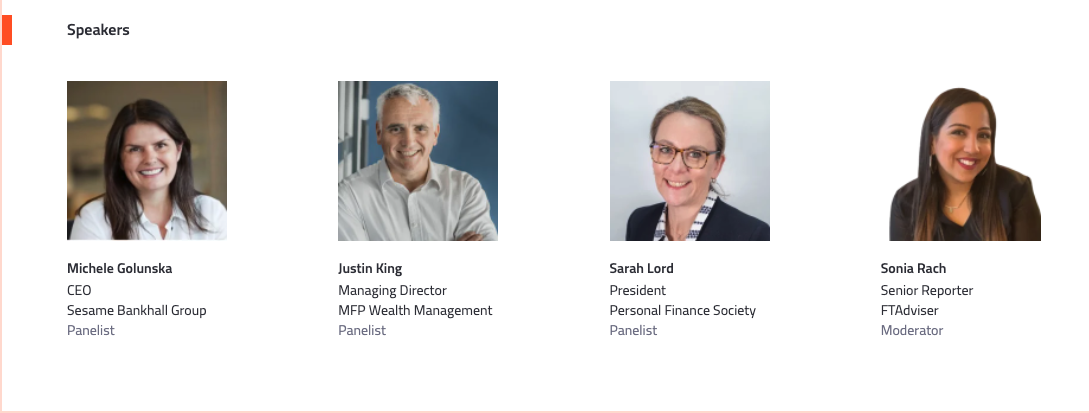

Alongside professional heavyweight Sarah Lord (President of the profession’s key body, the Personal Finance Society), journalist Sonia Rach from the Financial Times’ professional publication, and Sesame Bankhall Group’s CEO Micehle Golunska, we explored how the adviser community will need to evolve how we work to meet the changing needs of clients.

Challenging unrealistic expectations

One of the objectives of the debate was to explore how the financial advice sector can close the advice gap and offer planning services to lower income clients and not just wealthier people approaching retirement.

We explored the complexity of providing advice around later life which includes paying for care and navigating the UK social care policies. I was asked whether the financial advice sector should be responsible for closing the gap in people’s knowledge by offering advice services to the general public. The vast majority of people haven’t traditionally needed financial advice in this area, but the rules are changing rapidly, which brings complexity. I explained how the use of technology and growing content - such as my podcast and YouTube channel - will be key for many.

You can find out how we provide care planning services to our clients on this webpage.

Our session was part of a day-long online summit which welcomed leading UK-based financial advisers, regulators, policy makers, tax and legal experts to discuss the latest industry insights and share best practice examples of how to support clients to maximise their retirement goals. I hope that our discussion gave other advisers working in the retirement planning space some food for thought.