The hidden consequences of increases to personal allowance and higher rate threshold

The £50,000 higher rate threshold, accompanied by a £12,500 personal allowance, has some interesting hidden consequences.

The Chancellor’s announcement that in 2019/20 the personal allowance (PA) would rise to £12,500 and the basic rate band to £37,500 came as something of a surprise.

Prior to the Budget there had been suggestions he might even have frozen both at this year’s level. With the benefit of a few days hindsight since the Budget, the consequences of the increases and the resultant £50,000 higher rate threshold (HRT) are beginning to emerge.

Consequences of the changes

Reaching the 2017 Conservative manifesto targets for PA and HRT one year early has only a one-off cost, assuming they would anyway have been met in 2020/21. That is because there will be no increase to either PA or HRT in 2020/21, meaning that from then onwards the Chancellor is working from the same PA/HRT baseline for CPI indexation.

The HRT increase is automatically carried across to the upper earnings limit for full rate NICs. An employee earning £50,000 a year will save £860 a year in tax from the PA/HRT uplift in 2019/20 but will simultaneously lose £340 – 40% – in extra NICs.

A £50,000 HRT now means that theoretically the threshold at which the high income child benefit charge is triggered matches the end point for basic rate tax. Thus, someone with two children could be in the position where their marginal income tax rate (ignoring NICs, a de facto tax) goes from 20% at £49,999 to 57.89% from £50,000 to £60,000.

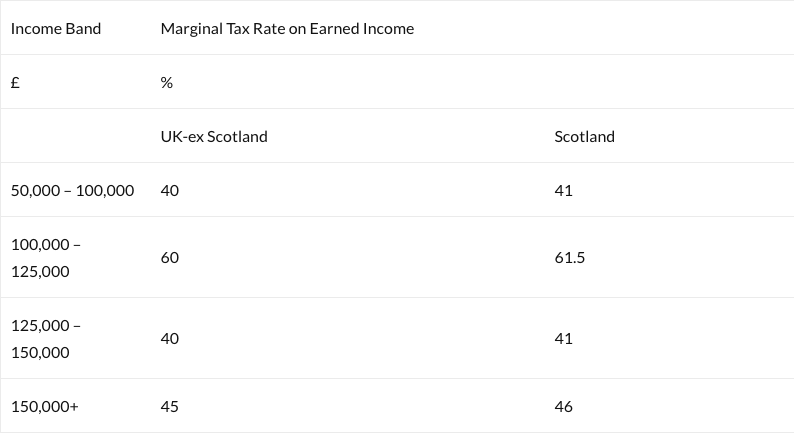

A £12,500 PA means that the band of income triggering taper of the allowance will run from £100,000 to £125,000. Thus in 2019/20, marginal rates of tax will look like this:

Good news for the Exchequer

While the effect for an additional rate taxpayer is the same as if all income between £100,000 and £150,000 were taxed at the old additional rate of 50%, the overall result is better for the Exchequer because there will be more people in the first £25,000 of that band, paying a rate 10% greater.

Nevertheless, a look at that table brings to mind the wise words of William Simon, a former US Treasury Secretary, who said that a tax system should look ‘like someone designed it on purpose’…

What this means for autoenrolment

Unless a decision is taken to the contrary, the upper end of ‘band earnings’ for autoenrolment will rise to match the HRT at £50,000. Allowing for the lower earnings threshold rise of £104 (to £6,136), that means the band will widen by £3,546 (8.8%) on an annual basis, just as the overall minimum contribution rate steps up from 5% to 8%.

Worst hit will be someone earning £50,000 as their larger contributions will also come with 20% rather than 40% tax relief in the next tax year.

Some commentators say the Budget has heightened the case for saying the income tax system needs a drastic overhaul. However, politics and a lack of spare money – most was spent on Monday – means the UK will continue to limp along with a system built not on purpose but by the sundry tweaks of successive Chancellors.